Quick links to the information:

Introduction & Case description

How we helped a Venture Capital Firm make better investments.

Venture capital (VC) firms navigate a complex landscape of high-risk, high-reward investments. Identifying promising startups with disruptive potential and assessing their long-term viability is crucial for success. However, traditional methods often rely on intuition, industry trends, and limited data, leading to subjective decision-making and missed opportunities.

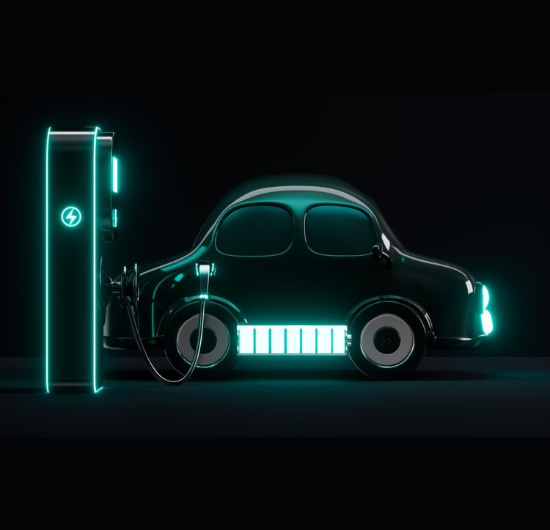

Our client, a leading venture capital with investment portfolio across the globe were planning to invest aggressively in the social commerce and EV automobile verticals. Before they get into this, they wanted a complete understanding of these markets in the SEA region along with customer trends and competitive analysis. They sought to enhance their investment strategy by incorporating data-driven insights and a deeper understanding of market dynamics. Their challenge was twofold:

- Lack of comprehensive market data: They needed a holistic view of emerging technologies, competitor landscapes, and potential market disruptions across various sectors.

- Limited understanding of target startups: They desired deeper insights into startup potential, including team expertise, product value proposition, and market fit.

Our SOlution

Industry Monitoring Research

We implemented a multi-pronged research approach to address these challenges:

- Industry Trend Analysis: We conducted a comprehensive analysis of EV and social commerce industries, identifying key trends, technological advancements, and potential market disruptors. We utilized industry reports, expert interviews, and data analysis tools to paint a clear picture of the evolving landscape.

- Competitive Intelligence: We also analyzed the portfolios and investment strategies of major competitors, uncovering their preferred sectors, investment criteria, and areas of focus. This helped our client identify potential blind spots and differentiate their investment approach.

- Target Startup Assessment: We conducted in-depth research on selected startups in the region to provide comprehensive due diligence insights to assess their viability, long-term potential, and potential risks.

The results

Enhanced investment decision-making

Our research resulted in significant improvements for the VC firm:

- Reduced Investment Risk: The comprehensive market and competitor analysis enabled the firm to identify and avoid potentially risky investments that did not align with their long-term strategy.

- Data-Driven Decision Making: The insights were crucial for the investment team who were looking to gather as much information as possible to make data enabled smarter investment decisions. They were able to benchmark these insights while making new investments in the sector and also guide the portfolio companies.

Market Research

Market Research Consumer Research

Consumer Research Industry Research

Industry Research Market Entry Strategy

Market Entry Strategy Feasibility Studies

Feasibility Studies Product Research

Product Research User Research

User Research Automobile & Mobility

Automobile & Mobility Banking and Finance

Banking and Finance Consumer Products & FMCG

Consumer Products & FMCG Ecommerce & Retail

Ecommerce & Retail Industry & Manufacturing

Industry & Manufacturing Government & Public Sector

Government & Public Sector Industry Associations

Industry Associations Technology & Software

Technology & Software Venture Capital & PE

Venture Capital & PE Consulting & Advisory

Consulting & Advisory India Entry Market Research

India Entry Market Research Innovation Consulting

Innovation Consulting KX Market Radar

KX Market Radar Business Model Development

Business Model Development Gen Z Navigator

Gen Z Navigator