Quick links to the information:

Introduction & Case description

Explaining the Research Challenge

The rise of Small and Medium-sized Enterprises (SMEs) in Saudi Arabia has been nothing short of impressive. In recent years, the country has witnessed a surge in entrepreneurial activity, with a growing number of individuals and businesses venturing into various sectors. This trend can be attributed to several factors. Firstly, the Saudi government has actively supported the development of SMEs through initiatives and reforms aimed at creating a conducive business environment. These include simplifying the registration and licensing processes, providing access to financing options, and offering training and mentorship programs. The government's commitment to diversifying the economy away from oil dependence has fuelled the growth of SMEs, as they are seen as vital contributors to job creation and economic development. Secondly, there has been a cultural shift in Saudi Arabia that embraces entrepreneurship and innovation. As of June 2022, there are around 900000 SMEs operating in the kingdom, a growth of more than 25% over the previous year.

Financing problems remain a significant challenge for Small and Medium-sized Enterprises (SMEs) worldwide, and Saudi Arabia is no exception. SMEs often encounter difficulties in accessing adequate funding for their operations and growth. One key issue is the limited availability of traditional financing options from banks and financial institutions. These institutions may perceive SMEs as risky investments due to their size, lack of collateral, and limited operating history. As a result, SMEs struggle to secure loans or face higher interest rates and stringent requirements, making it challenging to obtain the necessary capital for expansion, hiring, and innovation.

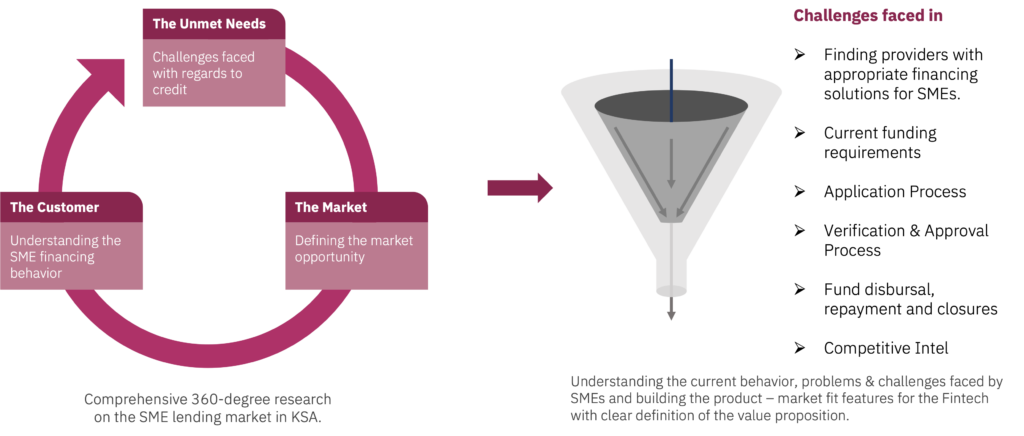

With this challenge in mind, the client is planning to build a Fintech platform (Lending) for SMEs in the country. This research was intended to provide a comprehensive 360-degree research on the SME lending market in KSA.

Our SOlution

Breaking down the Research Objective

Our 360-degree market understanding approach covered entire customer (SME) journey in availing credit facility.

We conducted Interviews/Discussions using a semi structured questionnaire with SME executives (Director level – In charge of credit / funding operations) to build a deeper analysis of the customer funding demands with respect to the current market scenario. This insights were also used to understand the service quality gaps.

The results

360-Degree Market Assessment

This comprehensive market research project by Knometrix provides valuable insights into the KSA SME lending landscape, empowering informed decision-making and product development strategies.

Market Analysis:

- Growth Trends: An analysis of historical trends in the KSA SME market was conducted, segmented by industry and region. This analysis identified future growth potential in specific sectors and locations.

- Market Sizing: The total available market (TAM) and serviceable available market (SAM) for SME lending in KSA were estimated.

- Funding and Credit Management: Current practices of SMEs in managing their funding and credit needs were studied.

- Competitive Landscape: Business models of leading SME lending platforms in KSA, GCC, and globally were analyzed. Case studies were built to showcase their unique selling propositions (USPs) and approaches to addressing challenges.

- Regulatory Environment: An analysis of regulations and challenges pertaining to Fintech and lending operations in KSA was conducted.

Customer Insights:

- Funding Needs: The primary purposes for which SMEs seek funding and credit were identified.

- Funding Sources: The current sources used by SMEs to meet their funding needs (banks, alternative lending, Fintech) were deeply studied, including factors influencing their choices, credit line sizes, and funding requirements.

- Challenges: The challenges faced by SMEs in securing funding and credit were explored through a deep dive into their user journey, encompassing source discovery, application process, KYC, verification/approval, fund disbursement, and loan closure.

- Desired Improvements: Expectations and factors that could smoothen business operations regarding funding and credit were identified.

Unmet Needs & Recommendations:

- Customer Segmentation: Customer profiles and trends were refined.

- Gap Analysis: Current market practices, challenges, and expectations were analyzed to identify unmet needs related to funding and credit operations within organizations.

- Competitive Benchmarking: A competitive analysis was conducted to inform future strategy.

- Product Roadmap: Inputs for the product roadmap were generated based on identified feature needs.

- FinTech Success Stories: Use cases showcasing successful funding experiences of existing FinTech customers were highlighted.

Market Research

Market Research Consumer Research

Consumer Research Industry Research

Industry Research Market Entry Strategy

Market Entry Strategy Feasibility Studies

Feasibility Studies Product Research

Product Research User Research

User Research Automobile & Mobility

Automobile & Mobility Banking and Finance

Banking and Finance Consumer Products & FMCG

Consumer Products & FMCG Ecommerce & Retail

Ecommerce & Retail Industry & Manufacturing

Industry & Manufacturing Government & Public Sector

Government & Public Sector Industry Associations

Industry Associations Technology & Software

Technology & Software Venture Capital & PE

Venture Capital & PE Consulting & Advisory

Consulting & Advisory India Entry Market Research

India Entry Market Research Innovation Consulting

Innovation Consulting KX Market Radar

KX Market Radar Business Model Development

Business Model Development Gen Z Navigator

Gen Z Navigator