The global economy is currently at an unprecedented level of turbulence. With inflation operating globally, the aftermath of a pandemic, climate crises and socio-political tensions combined with ever-increasing population and demand, emerging economies and stagnated developed economies, global interest rates are at a high of 30 years.

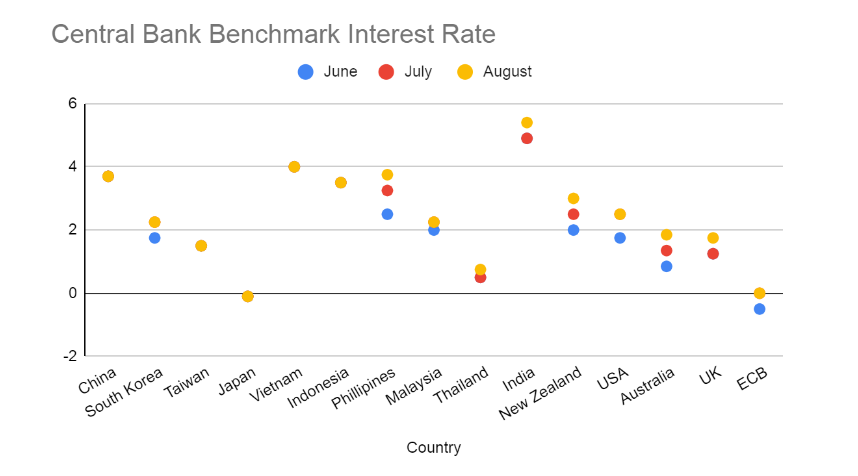

Interest rate is defined as the ‘amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum).’ It is of critical importance to influence the economy, by slowing or speeding up the growth. Influencing monetary policies at large, taking into consideration variables like investment, inflation, and unemployment, interest rates are of strategic importance for national governments or central banks. High-interest rates influence credit availability to fund purchases thus having a direct implication of slowing consumer demand. It further reduces capital available for businesses hence, strangulation of supply chains likewise. While on the other hand, a scenario of low-interest rates witnesses stimulating demand and larger availability of capital for business expansion; better liquidity in the economy. A period of continued low-interest rates can lead to periods of inflation as an aftermath of huge demand and lack of supply. And this is the scenario that is being observed in the major economies of the world, today. Central banks across the world are putting forth their aggressive moves in an attempt towards arresting the growing inflation. Nearly 45 countries have raised their interest rates in the last six months into 2022. The policy rates, interest rates that central banks charge commercial banks for loans or pay commercial banks for deposits, are at a tremendous height. Central banks regulating five out of the top ten traded currencies involved in 90% of the global trade have delivered a total volume of interest rate hikes reaching 1100 basis points since the start of 2022.

.

Facing the highest inflation rate in 40 years, the central bank of the USA, the Federal Reserve, has increased its policy rates for the third time this year making it the biggest since 1994. July was marked with a 75 basis-point (bps) rate rise.Reaching a 40-year high in June, Canada witnessed 8.1% inflation. The Bank of Canada has shown an aggressive rate hike amongst all others, raising it to 100 base points bringing the lending rate to 2.5%, the biggest in the past 24 years.

Raising the interest rates for the first time in more than 11 years, the European Central Bank has increased its key interest rate by 0.5 percentage points in order to tame the inflation in the Eurozone. The interest rates were marked negative since 2014 to boost the region’s economic revival. The high-interest rates came as a result of the growing CPI index reaching a record 8.6%, remarkably higher than the central bank’s target of 2%. Seventh rate hike in a row, New Zealand raised interest rates by 50 basis points (0.5%) to 3.0%. With this hike rate, the Reserve Bank of New Zealand marks a new high seen in the past 7 years. Marking the highest level in 27 years, the Bank of England increased its interest rates to reach 1.75%. The UK economy is likely to expand just 0.5 per cent next year as an outcome of the longest recession it faced since 2008. 12 central banks from a group of 18 big developing economies too raised rates to reduce inflation. Compared to 2,745 bps in 2021, the central banks of developing economies raised interest rates by 4,415 bps as of July 2022.

The Cascading Effect

Global growth is expected to plummet to 2.9% in 2022 from 5.7% in 2021. Advanced economies are set to see a sharp decline in growth from 5.1 per cent in 2021 to 2.6 per cent in 2022. It is forecasted that emerging economies will witness a major fall in growth compared to the annual average of 4.8 per cent from the 2011-2019 period. Falling from 6.6 per cent in 2021 to 3.4 per cent in 2022, emerging economies would require cohesive monetary policies to avert the worst consequences. The upward trend in interest rates and aggressive moves by central banks across the globe are receiving critical attention. Economists are expressing concern over the repercussions of demands dropping drastically. Lowered business expansion and growth will come along with a trailing employment level in the already grim picture of unemployment. Companies will tend to stop investing and hiring activities. The Federal Reserves have forecasted that unemployment levels would be around 3.7% by the end of the year with the economy growing at a rate of just 1.7%.

With higher returns on savings, the tremendous hike patterns in interest rates will have an impounding impact on businesses operating with flexible-rate loans. The hike in interest rates has global ramifications to a very huge extent. An aggressive Federal Reserve hike has a high chance of leading to a global recession. Being vigilant of the prevailing conditions and strategizing the way ahead is the way for businesses to prepare for the upcoming trend.

Sources: IMF, Thomas Reuters, World Economic Forum, World Bank.

Market Research

Market Research Consumer Research

Consumer Research Industry Research

Industry Research Market Entry Strategy

Market Entry Strategy Feasibility Studies

Feasibility Studies Product Research

Product Research Automobile & Mobility

Automobile & Mobility Banking and Finance

Banking and Finance Consumer Products & FMCG

Consumer Products & FMCG Ecommerce & Retail

Ecommerce & Retail Industry & Manufacturing

Industry & Manufacturing Government & Public Sector

Government & Public Sector Industry Associations

Industry Associations Technology & Software

Technology & Software Venture Capital & PE

Venture Capital & PE Consulting & Advisory

Consulting & Advisory India Entry Market Research

India Entry Market Research Innovation Consulting

Innovation Consulting KX Market Radar

KX Market Radar Business Model Development

Business Model Development Gen Z Navigator

Gen Z Navigator