Venture capital (VC) firms are under constant pressure to not only identify promising investment opportunities but also to maximize the returns on their investments. Market intelligence, the systematic gathering and analysis of information about markets, competitors, and consumer behavior, is increasingly recognized as a crucial tool for achieving these goals. Here’s why market intelligence is vital for venture capital firms looking to stay ahead of the curve.

Enhancing Portfolio Management with Predictive Analytics

Venture capital firms typically manage a diverse portfolio of companies, each with its own unique set of market dynamics. Predictive analytics, a core element of market intelligence, empowers VCs to forecast market trends and potential disruptions that could impact their portfolio companies. By analyzing vast amounts of data, firms can detect early warning signs of market shifts or emerging competitors, enabling them to make proactive decisions—such as providing additional funding, guiding strategic pivots, or planning timely exits.

For example, real-time tracking of consumer sentiment and technological adoption rates can help firms foresee a decline in demand for a particular product category. This foresight allows VCs to guide their portfolio companies to adapt quickly, thereby safeguarding investments and optimizing returns.

Identifying Untapped Market Opportunities

In the competitive world of venture capital, the ability to identify untapped market opportunities is a key differentiator. Market intelligence provides VCs with deep insights into industry trends, regulatory changes, and emerging consumer needs, allowing them to pinpoint sectors or niches that are ripe for innovation but underexplored.

For instance, by analyzing macroeconomic data and consumer behavior trends, a VC firm might uncover a growing market for sustainable packaging solutions driven by environmental regulations and consumer demand. By identifying such opportunities early, the firm can position itself as a leader in an emerging sector, ahead of the competition.

Mitigating Investment Risks Through Competitive Intelligence

Investing in startups is inherently risky, with many ventures failing to deliver expected returns. However, integrating competitive intelligence—a focused subset of market intelligence that tracks competitors’ strategies—can significantly mitigate these risks. By closely monitoring rival firms, new market entrants, and established incumbents, VCs can anticipate competitive moves and adjust their investment strategies accordingly.

For example, if a competing VC firm is making aggressive investments in a particular technology or market, this could signal either an emerging opportunity or an overheated market. Access to up-to-date competitive intelligence enables firms to make more informed decisions, whether it’s doubling down on a particular investment, shifting strategy, or exiting a market before it becomes overcrowded.

Strengthening Due Diligence with Market Insights

Due diligence is a critical aspect of the venture capital investment process, involving a thorough evaluation of a startup’s business model, financials, and market potential. Market intelligence significantly enhances the due diligence process by providing a comprehensive view of the startup’s competitive landscape, customer base, and overall market trends.

By incorporating market intelligence into due diligence, VC firms can validate or challenge the assumptions made by startups about their market size, growth potential, and competitive edge. This ensures that investment decisions are based on rigorous, data-driven analysis rather than overly optimistic projections, ultimately leading to better outcomes.

Conclusion: The Competitive Edge of Market Intelligence in Venture Capital

In a world where markets are increasingly volatile and competition is fiercer than ever, venture capital firms must go beyond traditional investment strategies. Building a robust market intelligence capability offers a competitive edge, enabling firms to make informed investment decisions, proactively manage portfolios, identify new opportunities, mitigate risks, and enhance due diligence. For VCs looking to navigate uncertainty and achieve long-term success, market intelligence is not just an asset—it’s a strategic imperative.

Talk to our expert consultants to build your market intelligence practice.

Market Research

Market Research Consumer Research

Consumer Research Industry Research

Industry Research Market Entry Strategy

Market Entry Strategy Feasibility Studies

Feasibility Studies Product Research

Product Research User Research

User Research Automobile & Mobility

Automobile & Mobility Banking and Finance

Banking and Finance Consumer Products & FMCG

Consumer Products & FMCG Ecommerce & Retail

Ecommerce & Retail Industry & Manufacturing

Industry & Manufacturing Government & Public Sector

Government & Public Sector Industry Associations

Industry Associations Technology & Software

Technology & Software Venture Capital & PE

Venture Capital & PE Consulting & Advisory

Consulting & Advisory India Entry Market Research

India Entry Market Research Innovation Consulting

Innovation Consulting KX Market Radar

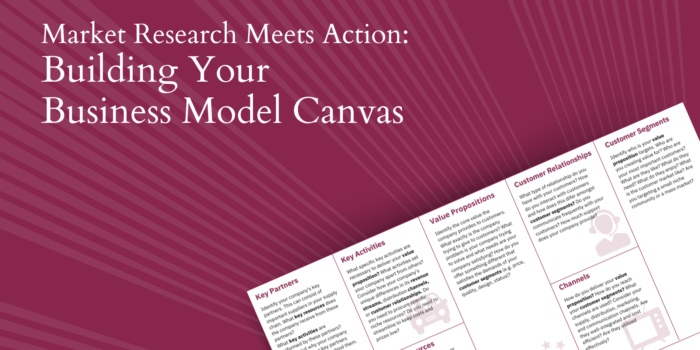

KX Market Radar Business Model Development

Business Model Development Gen Z Navigator

Gen Z Navigator