Small and medium-sized enterprises are the bedrock of most global economies. 95% of enterprises around the world are SMEs and are estimated to account for about 60% of private sector employment. This stands substantially right for a country like India. During the last five decades, the Micro, Small, and Medium Businesses (MSME) sector has grown as a very lively and dynamic segment of the Indian economy.

By encouraging entrepreneurship and creating major job possibilities at comparably cheap capital costs, it is the second largest contributor to the economic and social growth of the nation after agriculture. It is projected that these enterprises account for one-third of overall manufacturing output in the country.

Given that, in most developing countries, formal small and medium-sized enterprises are extremely fragile. Smaller organizations are especially susceptible to business interruption loss due to their comparatively limited financial and organizational size.

Business interruption Insurance

Business interruption insurance, commonly referred to as lost profit or loss income insurance, is created and bought to safeguard a business when its operations are interfered with and revenue is reduced as a result of a covered danger. These can include unanticipated occurrences like fires, natural catastrophes, equipment failures, cyberattacks, and other things that could disrupt corporate operations. Depending on the insurer and the particular policy, business interruption insurance plans might have different coverage and conditions.

Why is insurance so crucial for small and medium-sized enterprises?

Credit is a constraint for over 65 million formal MSMEs, and the total unmet loan demand in emerging nations is projected to be roughly US$5.2 trillion. Risk management and resilience are essential components of corporate expansion. But in MSMEs, this is highly ineffective and weak.

Even though getting insurance can be heavy on the tight budget an SME runs, it can save huge amounts and averse risk in case of a business interruption.

Develop resilience in times of liquidity crunches:

Owing to their limited financial resources, SMEs are particularly susceptible to unanticipated financial risks that can destabilize their operations and jeopardize employee pay and market expansion as a whole. Having insurance during this time might be very helpful. By providing liquidity coverage, business interruption insurance helps the company survive such situations.

Mitigate risks:

A small firm may be at the point of failure in the face of unforeseen occurrences like explosions, fires, natural disasters, riots, theft, etc., or defaulter third parties. Businesses that have insurance can recuperate their financial losses and carry on with their activities at the onset of such events.

Funding Opportunities:

Compared to companies without insurance, firms with insurance are more likely to receive funding (debt and equity) sooner. Having business insurance increases a company’s reputation because many stakeholders and customers prefer doing business with organizations they know are financially protected.

Protection from legal liabilities:

Defending legal actions is an expensive endeavor for medium-sized and small enterprises. Operating on a shoestring budget, any type of legal responsibility might devastate the company’s finances. Enterprises may be protected from such obligations and ensure that they can cover the costs of any losses concerning legal aspects by purchasing reliable insurance.

MSME Business Insurance: An Untapped Opportunity

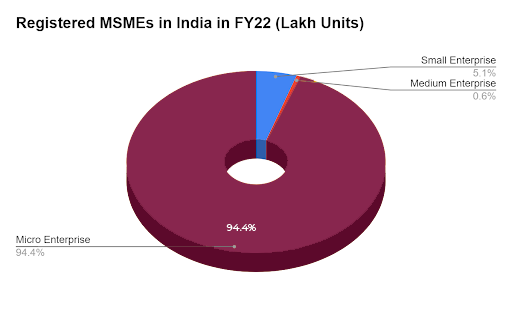

It is estimated that the worldwide loan availability deficit for small and medium-sized businesses is roughly $2.5 trillion. In comparison to the worldwide non-life insurance penetration of over 3% of GDP, India’s non-life insurance penetration is less than 1%. There are about 6.3 crore registered MSMEs in India that require insurance help, with just 5% of them being registered. As a result, the market opportunity is around $40 billion.

Because companies differ and may use a variety of resources, the business owner must recognize the possible risks to determine which insurance best suits their needs. Insurance coverage, when twinned with efficient risk management practices, is the best-suited way for small and medium enterprises to protect their assets and finances.

Market Research

Market Research Consumer Research

Consumer Research Industry Research

Industry Research Market Entry Strategy

Market Entry Strategy Feasibility Studies

Feasibility Studies Product Research

Product Research User Research

User Research Automobile & Mobility

Automobile & Mobility Banking and Finance

Banking and Finance Consumer Products & FMCG

Consumer Products & FMCG Ecommerce & Retail

Ecommerce & Retail Industry & Manufacturing

Industry & Manufacturing Government & Public Sector

Government & Public Sector Industry Associations

Industry Associations Technology & Software

Technology & Software Venture Capital & PE

Venture Capital & PE Consulting & Advisory

Consulting & Advisory India Entry Market Research

India Entry Market Research Innovation Consulting

Innovation Consulting KX Market Radar

KX Market Radar Business Model Development

Business Model Development Gen Z Navigator

Gen Z Navigator