The global economy’s economic trajectory appears to be on a bumpy course for the remainder of this year. Globally, overstretched supply chains, supply-demand mismatches, and commodity-driven cost pressures as a result of Russia’s invasion of Ukraine drove inflation up and increased pressure on both consumers and businesses. Traditionally at such an outset, the retail sector is at the forefront to bear the blow. This challenge is exacerbated when it comes to brick-and-mortar merchants that are still recuperating from the disruption created by the covid-19 outbreak.

From global conglomerates to store owners to e-retailers, all actors in the sector are now competing to guarantee that customers’ increasingly restricted discretionary income continues to flow in their favor. Being largely customer-driven, who now more or less entirely rely upon their gadgets when it comes to searching and buying products, the retail sector today needs to substantially build its technological capabilities.

As a result, they must be able to provide seamless experiences to their customers, such as an updated product catalog, AR/VR-enabled online testing rooms, real-time loyalty programs, and digital payment methods to ensure a smooth sale.

However, before going all in with their capital investments into technology, retailers need to understand how emerging technologies can bridge the gap between their current and future sales. They need to closely consider before delving into adopting any technology whether or not it aligns with the business’s future goals and brand position.

Shopping as an experience

In the stagnant retail business, customer experience is the true deal-maker or breaker in a pool of possibilities. Maintaining market relevance requires providing hassle-free, efficient, and consistent customer service. It covers the idea that rather than simply browsing and getting assistance from salespeople, the in-store experience should be full and engaging. Customers are looking for more immersive and fun ways to shop and spend their money, and integrating immersive technologies and offering a flawless purchasing journey will ensure a lasting impression. Virtual Reality (VR) and Augmented Reality (AR) are driving innovation by allowing customers to have a complete experience, such as virtually trying on garments using digital representations of themselves.

Government Initiatives

Microfinance Institutions Network (MFIN), the country’s microfinance industry association, has acted as an SRO (self-regulatory organization) since 2010. This has contributed to the creation of a responsible finance ecosystem by allowing the sector to build on strong foundations such as customer protection, an industry code of conduct, and policy advocacy.

The government has then persistently expanded on its existing microfinance infrastructure to push progressive financial incentives to support the country’s economy. In a similar vein, the Government of India established the Micro Units Development & Refinancing Agency (MUDRA) in 2015 to refinance collateral-free loans of up to 10 lakhs made by lending companies to non-corporate small borrowers, mostly for non-farm revenue development. MUDRA loans are divided into three categories: Shishu loans (up to 50,000), Kishor loans (50,000 to 5 lakhs), and Tarun loans (5 lakhs to 10 lakhs).

Growth

The third quarter showed a substantial increase in microcredit in the country, fueled by festivities and a recovering economy. Banks involved in microfinance through lending to joint liability group members have grown at a relatively slow 9.2% year on year. Small financing banks grew by 19.6%, while NBFCs gained the most traction (59%). From October 2022 and December 2022, total lender disbursements were Rs 77,819 crore, compared to Rs 70,582 crore during the same period the previous year. There has been a significant surge in loans with larger ticket amounts. Portfolios with ticket sizes ranging from 50,000 to 75,000 had a 45% year-on-year increase and 9.6% quarterly growth as of December 2022.

How the geographical regions fare

As of December 2022, the top ten states accounted for 84.6% of the total gross loan portfolio (GLP). In terms of disbursements during the third quarter, Bihar, Tamil Nadu, Uttar Pradesh, Karnataka, and West Bengal were the top five states, accounting for 56% of total disbursements. The Eastern region led the industry growth at 32%, followed by the South at 27% as of December 2022.

Challenges:

One of the industry’s main issues is its highly concentrated character, where it is concentrated in a few states and districts, making it subject to economic shocks and political instability in certain areas. For more balanced growth, it is critical to broadening credit distribution to other credit-deficient areas. Allocating the loan to other credit-deficient areas might provide a bigger boost to the country’s microfinance sector. Because microfinance loans are often modest and unsecured, lenders find it difficult to reclaim them in situations of failure or nonpayment. This increases the lenders’ operational expenses and has a detrimental impact on their bottom line.

Way Ahead:

In recent years, India’s microfinance business has grown dramatically. Yet, concerns such as unequal credit distribution must be addressed in order to achieve equitable growth. The sector must take steps to expand loan distribution and guarantee that the benefits of microfinance are available to the general public. Although the business is governed by the Reserve Bank of India (RBI), better laws and standards are needed to prevent predatory lending practices and guarantee consumer rights are protected.

Market Research

Market Research Consumer Research

Consumer Research Industry Research

Industry Research Market Entry Strategy

Market Entry Strategy Feasibility Studies

Feasibility Studies Product Research

Product Research Automobile & Mobility

Automobile & Mobility Banking and Finance

Banking and Finance Consumer Products & FMCG

Consumer Products & FMCG Ecommerce & Retail

Ecommerce & Retail Industry & Manufacturing

Industry & Manufacturing Government & Public Sector

Government & Public Sector Industry Associations

Industry Associations Technology & Software

Technology & Software Venture Capital & PE

Venture Capital & PE Consulting & Advisory

Consulting & Advisory India Entry Market Research

India Entry Market Research Innovation Consulting

Innovation Consulting KX Market Radar

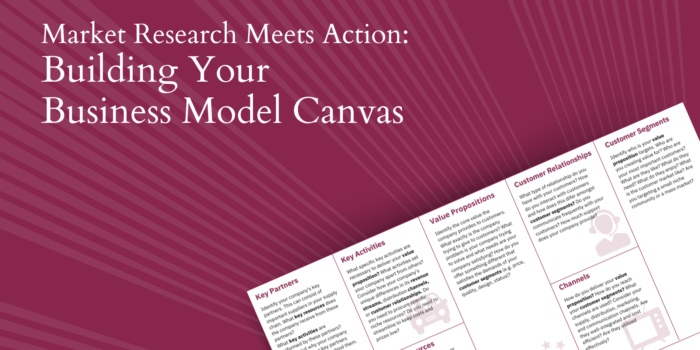

KX Market Radar Business Model Development

Business Model Development Gen Z Navigator

Gen Z Navigator