Banking & Finance

Talk to our Experts Here's how our market research advisors can help you meet your business goals.

Overview

Market Research for Banking & Finance Industry

Market research holds significant importance for both traditional banks and fintech companies. For banks, it's crucial for staying competitive and relevant in an ever-evolving financial landscape. Through market research, banks can gain insights into customer preferences, behavior, and emerging trends. This information allows them to tailor their services and offerings to meet the evolving needs of their clients, enhance customer satisfaction, and remain competitive in a rapidly changing industry.Fintechs, on the other hand, heavily depend on market research to identify gaps in the market and areas where innovative digital solutions can provide value. By understanding market dynamics and customer pain points, fintech companies can develop and launch new financial products and services that address specific market demands. Market research also helps fintechs make data-driven decisions regarding product development, marketing strategies, and customer acquisition, ultimately leading to their success in disrupting traditional banking models.

The global Fintech market is poised for continued growth and innovation. Fuelled by a young and digitally-savvy population, high smartphone penetration, and government initiatives to promote innovation, new entrants and coming up with cutting edge solutions and products. This makes market research and intelligence an invaluable tool for fintechs looking to grow and succeed in a highly competitive market.

We work with some of the leading Fintechs to stay ahead of the competition. Partner with Knometrix to gain a competitive edge, innovate with confidence, and contribute to the advancement of the financial industry.

Solutions

Explore our Banking & Finance Research offerings:

At Knometrix, we leverage cutting-edge tools and expert insights to predict the future of finance, showing you what’s on the horizon before it arrives.

- Customer Segmentation Analysis: Segmenting customers based on demographics, financial behavior, and preferences allows banks and financial institutions to tailor their products and services to specific customer segments.

- Product Development Insights: Market research provides invaluable insights into customer needs, preferences, and pain points, guiding product development initiatives within the banking and finance industry.

- Brand Perception Studies: Conducting brand perception studies and brand health tracking surveys helps organizations understand how their brand is perceived by customers and identify opportunities to enhance brand equity and trust.

- Regulatory Compliance Analysis: Market research helps organizations stay ahead of regulatory changes by monitoring legislative developments, assessing regulatory impacts, and ensuring adherence to industry standards.

- Market Trends Monitoring: Anticipating market trends and industry developments is critical for strategic planning and decision-making in the banking and finance industry. Market research enables organizations to track emerging technologies, competitive dynamics, and macroeconomic trends, allowing them to adapt their business strategies accordingly.

- Customer Satisfaction Surveys: Measuring customer satisfaction and loyalty through surveys and feedback mechanisms enables banks and financial institutions to identify areas for improvement and enhance the overall customer experience.

Benefits

Advantages of Market Research for Banking & Finance Companies

Informed Decision Making

Market research provides banks and financial institutions with actionable insights that enable informed decision-making across various business functions, from product development to marketing strategies.

Risk Mitigation

By analyzing market trends and customer behavior, organizations can identify potential risks and uncertainties, allowing them to implement proactive risk management strategies and minimize financial losses.

Competitive Advantage

Leveraging market research insights allows organizations to differentiate themselves from competitors, identify market opportunities, and stay ahead of industry trends, thereby gaining a competitive edge.

Enhanced Product Innovation

Market research enables banks and financial institutions to innovate and develop new products and services that meet evolving customer needs and preferences, driving growth and profitability.

Regulatory Compliance

By staying informed about regulatory changes and compliance requirements through market research, organizations can ensure that they operate within legal boundaries and avoid costly penalties.

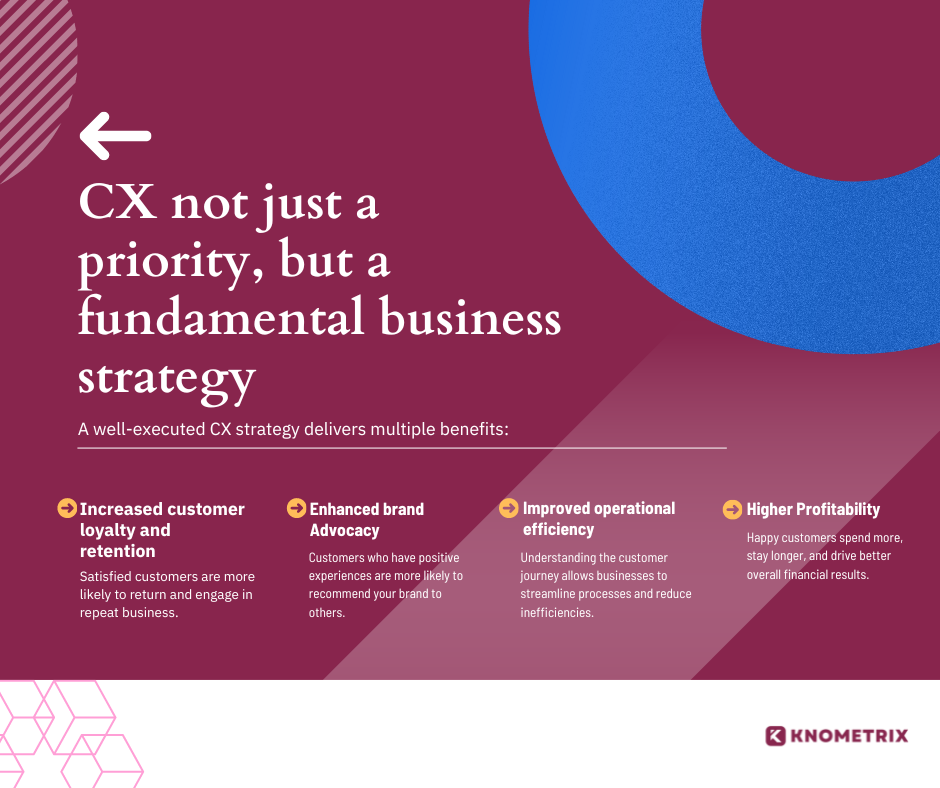

Improved Customer Satisfaction

Through continuous monitoring of customer feedback and satisfaction levels, banks and financial institutions can identify areas for improvement and deliver personalized services that meet customer expectations, leading to increased loyalty and retention.

We serve a diverse range of clients, from large corporations to small businesses and startups.

Industries we serve

Knometrix's partner with clients from diverse backgrounds:

Interested to know how we have helped some of the leading organizations? Read our Case Studies.

Insights/Resources

Expert insight and analysis on the latest trends.

Unlock Future Insights with AI Powered Predictive Market Research

AI in Market Research 2025: Transforming Insights with Precision and Innovation

Building a Robust CX Strategy for Your Organization: A Comprehensive Guide

We are always on the lookout for talented folk to join our team. Follow us on LinkedIn!

Market Research

Market Research Consumer Research

Consumer Research Industry Research

Industry Research Market Entry Strategy

Market Entry Strategy Feasibility Studies

Feasibility Studies Product Research

Product Research User Research

User Research Automobile & Mobility

Automobile & Mobility Banking and Finance

Banking and Finance Consumer Products & FMCG

Consumer Products & FMCG Ecommerce & Retail

Ecommerce & Retail Industry & Manufacturing

Industry & Manufacturing Government & Public Sector

Government & Public Sector Industry Associations

Industry Associations Technology & Software

Technology & Software Venture Capital & PE

Venture Capital & PE Consulting & Advisory

Consulting & Advisory India Entry Market Research

India Entry Market Research Innovation Consulting

Innovation Consulting KX Market Radar

KX Market Radar Business Model Development

Business Model Development Gen Z Navigator

Gen Z Navigator